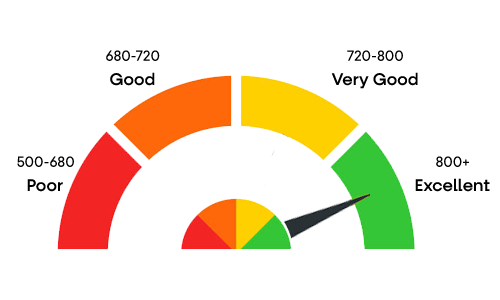

A credit score is a three digit numerical expression from 300 to 900 representing the measure of creditworthiness of an individual. This three digit number summarizes a consumer's credit history and behavior based on total debts, repayments of debts, number of recorded in a Credit Report, usually sourced from a Credit Bureau.

Lenders such as banks, NBFC, and credit card companies use this score to evaluate the potential risk of lending money to an individual with the use of this score, lenders determine who qualifies for a loan, at what rates, and the loan value. In other words, this scoring system determines the lender's decision to offer you credit.

You simply need to input your Permanent Account Number.

You will find your personal information in your PAN, voter ID, passport, birth certificate, etc.

Information such as your employer, monthly salary, and type of employment might be required.